Planning a trip can be an exhilarating experience, but it’s crucial to consider the unexpected. That’s where Chase Sapphire travel insurance comes in. Whether you’re embarking on a dream vacation or a quick getaway, having the right travel insurance coverage can make all the difference. In this comprehensive guide, we’ll delve into the ins and outs of Chase Sapphire travel insurance, exploring its benefits, coverage options, and how it can provide you with the ultimate peace of mind.

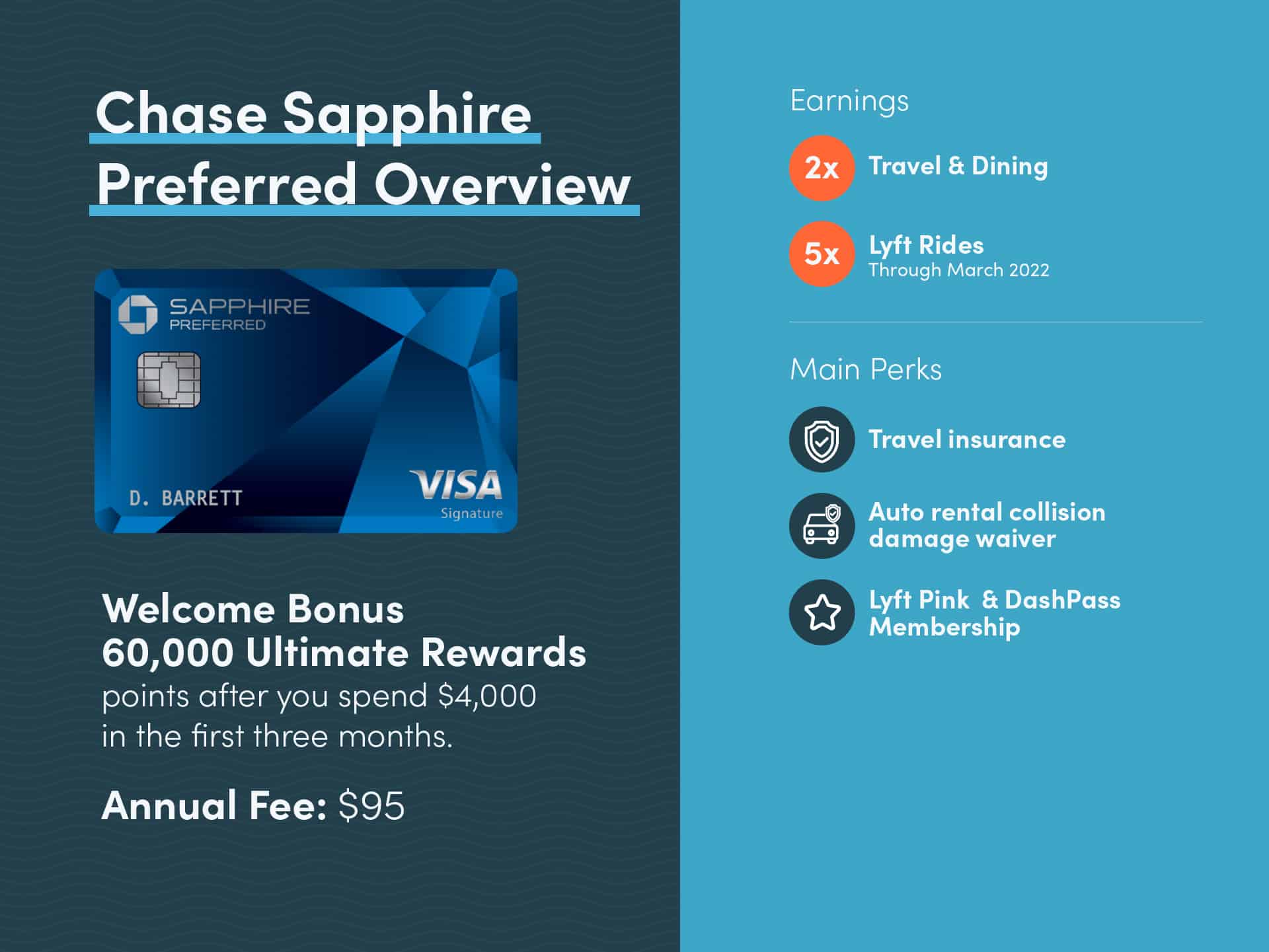

First and foremost, let’s understand what Chase Sapphire travel insurance entails. As one of the leading credit card providers, Chase offers extensive travel insurance benefits to its Sapphire cardholders. This coverage is designed to protect you against unforeseen circumstances that may arise during your travels, such as trip cancellations, delays, lost baggage, medical emergencies, and more. With Chase Sapphire travel insurance, you can rest easy knowing that you have a safety net in place to handle any unexpected hiccups along the way.

Understanding the Basics: What Is Chase Sapphire Travel Insurance?

When it comes to understanding Chase Sapphire travel insurance, it’s essential to familiarize yourself with the basics. This section will provide you with a comprehensive overview of what this insurance entails, including its coverage types, eligibility criteria, and the peace of mind it offers.

Coverage Types

Chase Sapphire travel insurance encompasses a range of coverage types to protect you during your travels. These include trip cancellation and interruption benefits, baggage delay and loss coverage, emergency medical and dental coverage, emergency evacuation and transportation coverage, and more. Each coverage type is designed to address specific travel-related risks, ensuring you have comprehensive protection throughout your journey.

Eligibility Criteria

In order to be eligible for Chase Sapphire travel insurance, you must be a cardholder of a qualifying Chase Sapphire credit card. The specific eligibility requirements may vary depending on the type of Sapphire card you hold. It’s important to review the terms and conditions of your card to ensure that you meet the eligibility criteria for travel insurance coverage.

Peace of Mind

One of the primary benefits of Chase Sapphire travel insurance is the peace of mind it provides. Traveling can be unpredictable, and having the right insurance coverage can alleviate worries about potential financial losses due to unforeseen circumstances. With Chase Sapphire travel insurance, you can embark on your journey with confidence, knowing that you have a safety net in place to protect you.

Unveiling the Coverage Options: What Does Chase Sapphire Travel Insurance Include?

Chase Sapphire travel insurance offers a comprehensive range of coverage options to ensure you’re protected throughout your travels. In this section, we’ll explore each coverage option in detail, providing you with a deeper understanding of what’s included in your policy.

Trip Cancellation and Interruption Benefits

One of the key coverage options offered by Chase Sapphire travel insurance is trip cancellation and interruption benefits. This coverage protects you financially if you need to cancel or interrupt your trip due to covered reasons such as illness, injury, or unforeseen events. It can reimburse you for non-refundable expenses such as flights, accommodations, and prepaid activities.

Baggage Delay and Loss Coverage

Chase Sapphire travel insurance also includes baggage delay and loss coverage. If your baggage is delayed for a specified period of time, this coverage can reimburse you for essential items you need to purchase during the delay. In the unfortunate event that your baggage is lost or stolen, this coverage can provide compensation for the value of your lost belongings.

Emergency Medical and Dental Coverage

Medical emergencies can happen anywhere, and Chase Sapphire travel insurance has you covered. This coverage provides reimbursement for medical and dental expenses incurred during your trip. Whether you need medical treatment, prescription medications, or emergency dental care, this coverage ensures that you’re protected against unexpected medical costs.

Emergency Evacuation and Transportation Coverage

In the event of a medical emergency or natural disaster during your trip, Chase Sapphire travel insurance offers emergency evacuation and transportation coverage. This coverage can assist in arranging and covering the costs of emergency medical transportation, repatriation, and evacuation to a medical facility capable of providing the necessary care.

Other Coverage Options

In addition to the aforementioned coverage options, Chase Sapphire travel insurance may include other benefits such as travel accident insurance, roadside assistance, and travel and emergency assistance services. These additional benefits further enhance your overall protection and ensure you’re well-prepared for any unforeseen circumstances.

Unlocking the Benefits: Why Should You Choose Chase Sapphire Travel Insurance?

With numerous travel insurance providers in the market, it’s important to understand the benefits of choosing Chase Sapphire travel insurance. In this section, we’ll explore the advantages that make Chase Sapphire a top choice for savvy travelers.

Comprehensive Coverage

Chase Sapphire travel insurance offers comprehensive coverage that addresses a wide range of travel-related risks. From trip cancellations to lost baggage and medical emergencies, the coverage options provided ensure you have peace of mind throughout your journey.

Competitive Pricing

Despite its extensive coverage, Chase Sapphire travel insurance maintains competitive pricing compared to other travel insurance providers. The affordability of the insurance, coupled with its comprehensive benefits, makes it an attractive choice for travelers seeking value for their money.

Convenience and Ease of Use

As a Chase Sapphire cardholder, accessing and utilizing your travel insurance benefits is convenient and straightforward. The insurance is seamlessly integrated with your credit card, ensuring a hassle-free experience when it comes to filing claims and seeking assistance during your travels.

Additional Perks and Rewards

Choosing Chase Sapphire travel insurance comes with additional perks and rewards. As a Sapphire cardholder, you may have access to exclusive travel offers, discounts, and rewards programs that can enhance your overall travel experience.

Unraveling the Fine Print: What Are the Exclusions and Limitations of Chase Sapphire Travel Insurance?

While Chase Sapphire travel insurance offers extensive coverage, it’s crucial to understand the exclusions and limitations that may apply. In this section, we’ll delve into the fine print to ensure you have a clear understanding of what’s covered and what’s not.

Pre-Existing Conditions

Chase Sapphire travel insurance may have limitations or exclusions for pre-existing medical conditions. It’s important to review the policy’s terms and conditions to understand how pre-existing conditions are defined and whether they are covered or excluded.

High-Risk Activities

Engaging in high-risk activities such as extreme sports or adventure activities may not be covered by Chase Sapphire travel insurance. It’s crucial to review the policy to understand which activities are considered high-risk and whether coverage is provided.

Traveling to Restricted Areas

Certain regions or countries may be excluded from coverage due to safety concerns or travel advisories. It’s important to review the policy to understand any restrictions or limitations when it comes to traveling to specific areas.

Other Exclusions

Chase Sapphire travel insurance may have additional exclusions and limitations, such as coverage for certain types of belongings or limitations on the amount of coverage provided. It’s essential to thoroughly review the policy’s terms and conditions to ensure you have a clear understanding of the coverage provided.

Activating Your Coverage: How to Enroll in Chase Sapphire Travel Insurance?

Ready to activate your Chase Sapphire travel insurance? This section will guide you through the process step-by-step, ensuring you’re well-prepared to make the most of your coverage on your next adventure.

Card Activation and Eligibility

In order to activate your Chase Sapphire travel insurance, you must be a cardholder of an eligible Chase Sapphire credit card. If you haven’t already, ensure your card is activated and that you meet the eligibility criteria for travel insurance coverage.

Understanding the Policy

Thoroughly review the travel insurance policy associated with your Chase Sapphire credit card. Familiarize yourself with the coverage types, limitations, and exclusions to ensure you have a clear understanding of what’s included in your policy.

Providing Necessary Information

When enrolling in Chase Sapphire travel insurance, you may be required to provide certain information such as your travel itinerary, personal details, and credit card information. Ensure you have all the necessary information readily available to streamline the enrollment process.

Confirming Coverage

Once you’ve enrolled in Chase Sapphire travel insurance, it’s crucial to confirm your coverage details. Review the confirmation documents provided to ensure all the necessary coverage options are included and that they align with your travel plans.

Making a Claim: What’s the Process for Filing a Chase Sapphire Travel Insurance Claim?

In the unfortunate event that you need to file a claim with Chase Sapphire travel insurance, understanding the claims process is essential. This section will provide you with a detailed overview of how to navigate the claims process seamlessly.

Gather Required Documentation

Before filing a claim, gather all the necessary documentation to support your claim. This may include receipts, medical reports, police reports, and any other relevant documentation required by Chase Sapphire travel insurance.

Once you have gathered all the required documentation, contact the claims department of Chase Sapphire travel insurance. They will provide you with the necessary forms and guide you through the claims process. Be sure to provide accurate and detailed information about the incident or event for which you are filing a claim. Fill out the claim form provided by Chase Sapphire travel insurance. Ensure that all the required fields are completed accurately and attach any supporting documentation as instructed. Be thorough and provide as much information as possible to expedite the claims process. After submitting your claim, it’s important to follow up with the claims department. They may require additional information or documentation to process your claim. Stay in touch and promptly provide any requested information to avoid delays in the claims process. Once your claim has been assessed, Chase Sapphire travel insurance will provide a decision regarding your claim. Review the decision carefully and contact the claims department if you have any questions or concerns. If your claim is approved, you will receive the reimbursement or assistance as outlined in your policy. With numerous travel insurance options available, it’s important to compare Chase Sapphire travel insurance to other providers in the market. This section will conduct a comprehensive comparison, highlighting the key differences and advantages of choosing Chase Sapphire. Chase Sapphire travel insurance offers a wide range of coverage options that are on par with or even exceed those offered by competitors. From trip cancellation to medical emergencies, the comprehensive coverage provided by Chase Sapphire sets it apart from many other travel insurance providers. Chase Sapphire travel insurance is often competitively priced compared to other providers in the market. While pricing may vary based on factors such as coverage limits and trip duration, Chase Sapphire offers value for money with its extensive coverage and affordable premiums. Chase Sapphire has a reputation for excellent customer service and support. Their dedicated claims department and travel assistance services ensure that cardholders receive prompt and efficient assistance when needed. This level of customer service sets Chase Sapphire apart from many competitors. Chase Sapphire travel insurance often comes with additional benefits and perks for cardholders. These can include travel discounts, access to exclusive events, and rewards programs that enhance the overall travel experience. When comparing Chase Sapphire to other providers, it’s essential to consider these additional benefits that come with the insurance coverage. While Chase Sapphire travel insurance offers comprehensive coverage, there are tips and tricks you can employ to maximize the benefits and make the most of your policy. This section will provide valuable insights to help you get the most out of your Chase Sapphire travel insurance. It’s crucial to thoroughly read and understand your Chase Sapphire travel insurance policy. Familiarize yourself with the coverage options, exclusions, and limitations to ensure you know exactly what is covered and what is not. This knowledge will enable you to make informed decisions and avoid any surprises when filing a claim. When traveling, it’s important to keep all relevant documentation and receipts. This includes travel itineraries, booking confirmations, receipts for pre-paid expenses, and any relevant medical documentation. These documents will be crucial when filing a claim, as they provide evidence of your expenses and the incidents that occurred. Chase Sapphire often provides access to travel assistance services for cardholders. These services can include help with rebooking flights, finding accommodations, and providing travel advice. If you encounter any difficulties during your trip, don’t hesitate to contact the travel assistance services to make the most of your insurance coverage. Having a clear understanding of the claims process will help streamline your experience when filing a claim. Familiarize yourself with the necessary steps, required documentation, and deadlines to ensure you submit a complete and accurate claim. This will increase the likelihood of a successful claim and a prompt reimbursement or assistance. There’s no better way to understand the value of Chase Sapphire travel insurance than through real-life experiences. In this section, we’ll provide testimonials from satisfied Chase Sapphire travel insurance policyholders. These firsthand accounts will showcase how the insurance coverage has saved the day for fellow travelers and provided them with invaluable peace of mind. “During my recent trip, my luggage went missing. I was devastated, but luckily, I had Chase Sapphire travel insurance. The claims process was straightforward, and I was promptly reimbursed for the value of my lost belongings. Thanks to Chase Sapphire, I was able to replace my essentials and continue enjoying my trip without missing a beat.” “Due to unforeseen circumstances, I had to cancel my dream vacation at the last minute. Thankfully, I had Chase Sapphire travel insurance. The reimbursement for my non-refundable expenses was a lifesaver. I was devastated about canceling my trip, but knowing that I didn’t suffer a financial loss made the situation a little easier to bear. I highly recommend Chase Sapphire travel insurance to anyone planning a trip.” When it comes to travel insurance, it’s natural to have questions. In this final section, we’ll address common questions and concerns about Chase Sapphire travel insurance. From coverage limits to eligibility, we’ll provide you with the answers you need to make an informed decision. A: To be eligible for Chase Sapphire travel insurance, you must be a cardholder of a qualifying Chase Sapphire credit card. Specific eligibility criteria may vary depending on the type of Sapphire card you hold. Review the terms and conditions of your card to ensure you meet the eligibility requirements. A: Coverage for pre-existing medical conditions may vary depending on the specific policy. It’s important to review the terms and conditions of your Chase Sapphire travel insurance to understand how pre-existing conditions are defined and whether they are covered or excluded. A: To activate your Chase Sapphire travel insurance, ensure that your card is activated and that you meet the eligibility criteria. Review the travel insurance policy associated with your Chase Sapphire credit card and provide any necessary information as instructed to enroll in the coverage. A: Engaging in high-risk activities may not be covered by Chase Sapphire travel insurance. It’s important to review the policy to understand which activities are considered high-risk and whether coverage is provided. If you plan on participating in such activities, you may need to explore additional insurance options. In conclusion, Chase Sapphire travel insurance is a comprehensive and reliable option for travelers seeking protection and peace of mind. With its extensive coverage options, competitive pricing, and convenient customer service, it stands out as a top choice among travel insurance providers. By understanding the basics, exploring the coverage options, and maximizing the benefits, you can embark on your next adventure with confidence, knowing that Chase Sapphire has you covered. Bon voyage!Submit the Claim Form

Follow Up and Provide Additional Information

Review the Claim Decision

Comparing Chase Sapphire Travel Insurance: How Does It Stack Up Against Competitors?

Coverage Options

Pricing

Customer Service and Support

Additional Benefits

Tips and Tricks: Maximizing Your Chase Sapphire Travel Insurance Benefits

Read the Policy Thoroughly

Keep Documentation and Receipts

Contact the Travel Assistance Services

Understand the Claims Process

Real-Life Experiences: Testimonials from Chase Sapphire Travel Insurance Policyholders

Testimonial 1 – Lost Luggage

Testimonial 2 – Trip Cancellation

Frequently Asked Questions: Your Queries About Chase Sapphire Travel Insurance Answered

Q: Who is eligible for Chase Sapphire travel insurance?

Q: Does Chase Sapphire travel insurance cover pre-existing medical conditions?

Q: How do I activate my Chase Sapphire travel insurance?

Q: Are high-risk activities covered by Chase Sapphire travel insurance?